Organizing Financial Success™

Let’s get acquainted and discuss your situation. A get-acquainted meeting is the best method we know for you check us out. It’s also the method we use to determine if our resources meet your needs. All get-acquainted meetings are free.

Let's Talk: (952) 935-0707

Organizing Financial Success™

Let’s get acquainted and discuss your situation. A get-acquainted meeting is the best method we know for you check us out. It’s also the method we use to determine if our resources meet your needs. All get-acquainted meetings are free.

Let's Talk: (952) 935-0707

Organizing Financial Success™

Let’s get acquainted and discuss your situation. A get-acquainted meeting is the best method we know for you check us out. It’s also the method we use to determine if our resources meet your needs. All get-acquainted meetings are free.

Let's Talk: (952) 935-0707

- What Makes Us Unique?

- Our Story

- Client Satisfaction

- Features and Benefits

- Professional Credentials and Organizations

- What is a Financial Plan?

- Regulatory Disclosures

What Makes Us Unique?

We are unique among financial planning firms due to a distinct combination of attributes –

- Focus on small business owners, professional practitioners and retirement planning for individuals

- Comprehensive advice for all elements of financial life

- Small by choice and know our clients well

- Trust cultivated by doing what we say we will do

- Rich background of professional experiences

- Fee-only, independent and professional

Our values make us who we are.

Small By Choice

Money Matters is a successful financial planning firm, yet it remains small by choice. We know each client well. Beyond their finances, we know their values, interests and preferences. Everything we do is geared towards a client's unique personal traits.

Trust

Long-term relationships endure because of trust. Rod's understated style generates a feeling of confidence. He truly loves helping clients be successful. Salesmanship is missing from his DNA. Instead, he provides alternatives and explains their pros and cons. New clients come largely from existing client referrals.

Communications

Most clients say they simply are "not a numbers person". Rod refines complex financial concepts into understandable charts and graphs so a non-financial person will understand. He is able to maintain a firm grasp of the technical details while laying out the big picture.

Professional

Rod is a Certified Public Accountant, Certified Financial Planner and NAPFA-Registered Financial Advisor. The Firm employs the "fee-only" business model, no sales commissions or hidden remuneration is received. Clients’ interests come first. Work begins when clients understands the project and agrees to it. If not satisfied with our work, fees will be reduced or returned.

Competence

Rod has a rich tapestry of professional experiences – CPA, former bank CFO and director, former partner in a large CPA firm, consultant to small business and cost-effective uses of life insurance.

Comprehensive Approach

The more we know of a client’s financial life, the more we can help manage his/her financial life successfully. Financial security is not achieved unless all financial components are working together in harmony. Opportunities are created by understanding the interactions between a client’s individual financial components. Comprehensive financial planning helps identify the opportunities.

Our Story

Successful

Money Matters was founded in June 1998. It is a practice, not a business. Our goal is not to be a big firm. Clients come first. Relationships count. We are motivated to serve, and we grow as we serve our clients well. We believe this attitude is responsible for our success. And we define success by the measurements listed below.

- Our clients are the best – smart, successful, enjoyable

- We like helping clients organize their finances for success

- Most clients (80%) come from referrals

- Most clients (95%) retain the firm for multiple financial, tax and investment services.

- Client turnover is extremely low. On average, our present clients have been with us for over 7 years. Our first client is still with us.

Family Owned and Managed

The firm is owned by Rod and his family. Each member works part-time or provides consultation to the firm. Family members comprise the firm’s Board of Directors.

How did you become a financial planner?

Did you know that financial planners usually migrate to the profession from other careers? Financial planners offer advice to clients in several areas - investments, taxes, risk management, debt management, etc. So, the profession attracts individuals who have experience in all these areas. In fact, the best advisors have a wide-range of business experiences and financial expertise before becoming financial planners.

Some future financial planners start out selling insurance or investments products. Later they gravitate to more sophisticated levels of selling. Others become proficient in a profession - such as public accounting, law and banking - and then specialize in financial planning. Rod followed the professional route to become a financial planner.

His expertise comes from career stops as a CPA, consultant, entrepreneur and bank CFO. Along the way, he developed technical expertise in investments, taxes, finance, insurance and risk protection. His experience is useful when managing investment portfolios, helping a couple set retirement goals, identifying tax planning opportunities, or helping someone launch a new business. Finally, he has gained wisdom from experiencing life's ups and downs first-hand, a valuable perspective when guiding others through their financial ups and downs.

Before Money Matters

Money Matters is built from a foundation of closely-related career experiences. Career accomplishments leading up to founding Money Matters are listed in bullet points below.

- Became a CPA and climbed the professional ladder to become Partner in the large CPA firm of KPMG Peat Marwick.

- Left the large CPA firm environment to start a CPA and consulting firm focused on banks and insurance.

- His firm provided risk protection consultation to Lloyds of London underwriters on their insured bank clients throughout the US.

- Executive Vice President, Chief Financial Officer and Director of Highland Bank, a community banking group with several locations in the Twin Cities.

Key Career Experiences

Insider's look at financial companies

Stock and bond public offerings

Observing leadership of successful CEOs

- Fundamental stock analysis

- Insurance policy comparison

Investing in a start-up

Turning-around a distressed business

- Long-range financial plans

- Gauge investment risk

Small business financing

Surviving a downturn

- Advice to business owners

Managing bond portfolio and hedges

Consumer compliance rules

- Manage debt

- Monitor bond risks

Dealing with the IRS

Business entity selection

- Tax planning advice

- Understanding the IRS

Client Satisfaction

The Rolling Stones' classic song "(I Can't Get No) Satisfaction" is a reminder of the gap between marketing hype and customer loyalty.

"(I Can't Get No) Satisfaction"

"When I'm drivin' in my car

and a man comes on the radio

he's tellin' me more and more

about some useless information

supposed to fire my imagination.

I can't get no, oh no no no.

Hey hey hey, that's what I say.

I can't get no satisfaction,

I can't get no satisfaction.

'Cause I try and I try and I try and I try.

I can't get no, I can't get no."

Mick Jagger and Keith Richards, 1965

Most financial planning firms tout good client service . . . Money Matters can demonstrate its consistently high levels of client satisfaction.

Reason #1 - Independent Client Satisfaction Survey

In a 2008 survey an independent consultant firm conducted a double-blind survey of Money Matters clientele. Almost 80% of Money Matters' clients responded to the survey, a notably high participation rate. The feedback we received makes us proud. We learned that clients appreciate how we respond to their calls and emails in a timely manner, and how our work helps them make better decisions than if they were to do things on their own.

Reason #2 - Client Retention

Over 95% of our clients use us for more than one type of service. The average length of a client's stay with us is over 7 years. The first client when we began in 1998 is still with us.

Reason #3 - Referrals from Clients and Friends

Nearly 80% of existing clients came to us as referrals by other clients or friends.

Reason #4 – Who’s Who and Client Satisfaction Survey

Rod was named to two Who’s Who Registries, Cambridge and Trademark. Members are a select group of professionals who are leaders in their respective industries. He was listed as a FIVE STAR Best in Client Satisfaction by Mpls. St. Paul Magazine and Twin Cities Business in their survey of readers and review of professional credentials.

Features and Benefits

Client Support and Service Commitment

Client support and service is at the core of client satisfaction, and is important to us. Stated simply, here are our support and service promises to our clients:

- We do what we say we will do.

- We respond to phone calls and e-mails promptly, usually within one day.

- We communicate project objectives, procedures, deadlines and fees in writing in advance.

- We place quality and accuracy foremost.

- We fit recommendations to suit individual client preferences and goals.

- We strive to communicate financial complexities clearly and understandably.

- We adjust fees if we err or fall short of expectations.

- We protect your privacy by keeping information confidential and secure.

- We place clients’ interests first always.

Help Defining Clients’ Financial Goals

Without financial goals, financial planning is like shooting in the dark. So, we help clients understand, articulate and quantify their financial goals at the beginning of our relationship. With financial goals, we can make targeted recommendations, measure progress and help clients achieve their goals. Goal-setting is critically important in retirement planning. We use methodology developed by acclaimed behavioral economist Dr. Shlomo Benartzi.

Investment Custody and Transaction Benefits

Money Matters is an independent Registered Investment Advisor, which means we work for our clients - not a brokerage firm. Our preferred investment custodian is TD Ameritrade Institutional Services. They offer many benefits, including:

- Client on-line access to investment accounts, and investor tools for client use

- For mutual fund purchases:

- Access to 18,000 mutual funds from all major fund families,

- Over 11,200 or 63% have no a transaction fee

- Over 10,800 or 60% are so-called no-load funds

- Many remain open for purchase that are closed to other investors

- Many have lower purchase amount thresholds than available to other investors

- For exchange-traded funds, 100 may be purchased without a transaction fee

- Low transaction cost for individual stocks and low price spreads for individual bonds

Quartile.Pro™ Investment Methodology

Quartile.Pro™ is the unique system developed by Money Matters, Inc. to evaluate the comparative performance of mutual funds, exchange traded funds and, even stocks. It is a commonsense approach to monitoring investment performance on an “apples to apples” basis. The analytical methodology has been refined and perfected over the past 14 years.

Each month, we rank the performance of mutual funds by their investment category. There are over 100 mutual fund investment categories (e.g. large domestic growth stocks, mid-size foreign value stocks, etc.). Performance is ranked from best to worst within each category. The ranking is divided into 4 performance groups from best to worst. Each group, called quartiles, contains 25% of all funds in a category. Quartiles are identified by number and color as shown below.

Quartile.Pro™ Performance Rank

Quartile.Pro™ benefits:

- Provides a visual, instinctive method to critique investment performance.

- Compares “apples to apples” by ranking one fund’s performance to all similar funds.

- Comparing only similar investments reduces bias caused by unequal risk levels and dissimilar investments.

- Measures fund manager judgment and investment strategy effectiveness.

- Indicates fund’s performance dependability (lower volatility) relative to all similar funds.

- Highlights trends such as high or low performance streaks.

Financial Planning

“Oddly, many “financial advisers” barely give advice at all. Scott Smith, a director at Cerulli Associates, a research firm based in Boston, estimates that … only about 26% provide comprehensive advice on financial planning.”

Source: Jason Zweig’s The Intelligent Investor column from Wall Street Journal March 2014.

Approaching retirement is the most common motivator to request comprehensive financial planning. At the heart of our comprehensive retirement plans is a financial projection. We project a person's present financial facts far into the future using specific financial assumptions of future investment returns, inflation, etc. Our financial plans are comprehensive - they cover retirement, investments, debt, income taxes, cash flows, risk protection, and legacy gifts. They include robust analysis, multiple "what if" scenarios and Monte Carlo Simulations. Our objective is to provide a list of recommendations that, when implemented, would far exceed the plan's cost.

Integrated Solutions from a Single Source

Our clients enjoy being able to pick up the phone and call Money Matters with any, and all, financial questions. The feel secure in knowing that a single source can provide advice on all aspects of their financial lives.

Sample Client Projects for Individuals

Sample Projects for Small Business Owners and Professionals

Professional Credentials and Organizations

- Certified Public Accountant (CPA)

- Certified Financial Planner® (CFP)

- Chartered Life Underwriter® (CLU)

- NAPFA-Registered Financial Advisor

- Fellow, Life Management Institute (FLMI)

Few advisors earn all these designations.

Professional Organizations

- National Association of Personal Financial Advisors

- Minnesota Society of Certified Public Accountants

- National Association of Tax Professionals

Stringent Professional Education

Each year, Rod completes approximately 70 hours of classes in financial planning and tax professional conferences in order to maintain technical proficiency and to meet continuing education requirements for CPA license, NAPFA membership and CFP® designation.

Professional Credentials

Certified Public Accountant - www.mncpa.org

The term CPA and Certified Public Accountant behind the name indicates the individual passed one of the most rigorous examinations of any profession and holds an active professional license. Rod has been an actively-licensed CPA for most of his career. The profession requires compliance with its Code of Ethics and maintaining technical proficiency through continuing professional education.

Being a CPA provides experience in two key areas:

- Financial statement report of companies with publicly-traded securities - source of most financial information used to research a company's stock or bond

- Tax planning strategies and tax regulations - routinely represents clients before the IRS in tax matters.

Certified Financial Planner - www.cfp.net

CFP® and Certified Financial Planner® indicate that an individual has passed a series of professional examinations, maintains technical proficiency through continuing professional education, and is guided by its Code of Ethics and Rules of Conduct. Rod has been a CFP® since 2002.

NAPFA-Registered Financial Advisor - www.napfa.org

Rod is a member of the National Association of Personal Financial Advisors, considered by many to be an organization of elite financial planning professionals. NAPFA-Registered Financial Advisors are committed to these Core Values:

Competency - Requiring the highest standards of proficiency in the industry.

Comprehensive - Practicing a holistic approach to financial planning.

Compensation - Using a Fee-Only model that facilitates objective advice.

Client-Centered – Being a fiduciary in which clients’ interests are always first.

Complete Disclosure - Providing an explanation of fees and potential conflicts of interest

Rod is a member of the National Association of Tax Professionals. The organization provides technical programs and resources to tax practitioners.

What is a Financial Plan?

Not all financial planners prepare financial plans! Not all financial plans look alike or provide the same type of information. Some call any advice a financial plan, even if it is not written.

Comprehensive Planning

Here is what NAPFA (National Association of Personal Financial Advisors) has to say about financial planning. Rod is a NAPFA-Registered Financial Advisor and provides comprehensive financial plans.

“NAPFA-Registered Financial Advisors are primarily engaged in providing comprehensive financial planning. Most of the nation’s financial advisors pay lip service to comprehensive planning but few actually provide it. In recent years, largely because of the runaway stock market of the 1990s, the practice and public perception of financial planning tended to be overly focused on investments in general, and stocks in particular – a trend encouraged and reinforced by the fact that most providers of financial advice benefit from the sale of financial products.

“As a result, many members of the public have received a painful reminder frequently forgotten: the value of investments can fall as well as rise. If they were relying on a financial advisor who was merely providing investment advice, they are probably surprised by and poorly prepared for the bear market.

“Why? If an advisor doesn’t understand the client’s full picture, the quality of advice in any one area, including investment advice, can suffer significantly. Competent and informed investment decisions must take into account all the other factors that comprise an investor’s financial profile, including tax, estate planning, insurance, risk tolerance, specific family circumstances and ultimate financial goals. A truly comprehensive financial plan, therefore, is much more than investment advice. It is an all-purpose tool that enables planner and client, working together, to make better financial decisions because each individual decision is made within the context of the full picture.” (Source: www.napfa.org/consumer/faq.asp)

Financial Projections

The financial planning profession began in 1973 and is immature when compared to the CPA profession, which dates back to 1887. CPAs have been preparing financial projections for decades under a specific set of profession standards. By contrast, a CFP® has only a few general guidelines they must follow.

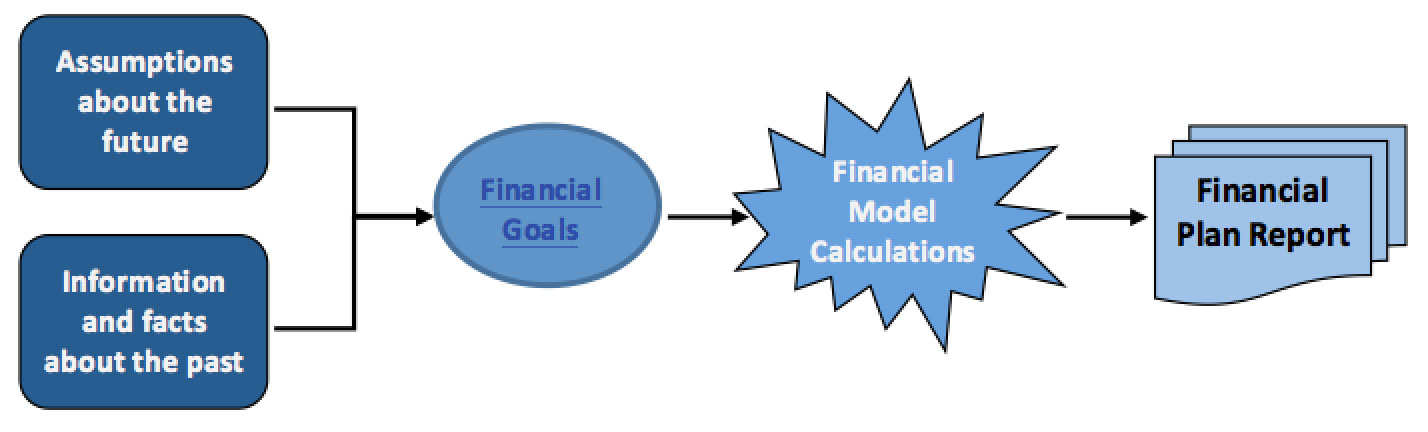

Financial Planning Assumptions

Financial plans consist of several components – assumptions, financial model or calculations and report. Assumptions are the most critical element, in my view. Following the maxim – “garbage in, garbage out” – a financial planning report is only as accurate as the assumptions used to create the plan. Here are some of the assumptions that are typically found in one of our financial plans.

- Expected future inflation rate, including alternative rates under various scenarios.

- Expected long-term total return on investments

- Returns are dissected by appreciation, taxable and non-taxable cash income, reinvested or distributed.

- Returns are usually modeled under various scenarios.

- Portfolios are further split into qualified retirement, taxable brokerage and Roth IRAs.

- Expected time of investment sales, and amount of gains on sales.

- Details of expenses by category and income by category, including changes in various expenses as future circumstances change and savings for periodic large expenditures such as vehicles or travel.

- Expected future federal and state income and estate tax rates.

- Expected future levels of auto, home, health, disability, umbrella, life and long-term care insurance coverage, costs, benefit levels, cash value accumulations, etc.

Hopefully, the list of typical assumptions demonstrates the depth to which we identify assumed future events. Typically, the list of assumptions is several pages in length.

“What if” Scenarios

Some financial planners illustrate a single projection of most likely events and the time of their occurrence. Such a short-cut decimates the value of the financial plan. An important feature of our financial plans is to project various alternative scenarios, such as premature death, total disability, extended long-term incapacity, early retirement, heightened inflation and reduced investment returns. Some scenarios may be alternatives under consideration. Others are, hopefully, remote possibilities. The purpose for modeling alternative scenarios is either (1) to test the adequacy of insurance protection, (2) to identify the optimal combination or timing of multiple events, or (3) to help the client decide upon key alternatives, like buying a vacation home, when to retire, or starting a new business.

Regulatory Disclosures

Money Matters, Inc. is a Minnesota business corporation and Registered Investment Advisor. Rod Roath, its President, is a Certified Public Accountant (CPA) licensed in Minnesota, a Certified Financial Planner®, and a member of the National Association of Personal Financial Advisors (NAPFA).

All written content is for informational purposes only and does not constitute a complete description of our investment services or performance results. This website is not a solicitation or an offer to provide fee-only financial planning, tax planning or tax return preparation and investment advisory services except in Minnesota or other states where an exemption or exclusion from such registration exists. Information contained herein is limited to providing general information on our services and provides a means for you to contact us for specific advice. Accordingly, we do not render investment, tax and financial planning advice through this website.

Professional advice can only be rendered after all of the following conditions are met:

- Through discussions, we agree upon a project's objectives, approach, methods for reporting our findings, timetable and fees.

- Engagement details are described in an engagement letter, client agreement or investment advisory agreement that is signed and returned, and

- For investment-related advice, we deliver to you our most recent Brochure, the contents of which are prescribed by the Securities and Exchange Commission. The Brochure provides informative information about our firm and services.

Information presented on this site is obtained from sources believed to be reliable. We do not warrant or guarantee the timeliness, completeness, suitability or accuracy of any information posted on this or any linked website. Nothing on this website should imply that past results are an indication of future performance. Opinions expressed herein are solely those of Money Matters, Inc.

IRS Circular 230 Disclosure: Pursuant to requirements imposed by the Internal Revenue Service, any tax advice contained in this website, newsletters or articles provided by our firm is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the United States Internal Revenue Code or promoting, marketing or recommending to another person any tax-related matter. Please contact us if you wish to have formal written advice on this matter.

Let's Start Talking

Let’s get acquainted and discuss your situation. A get-acquainted meeting is the best method we know for you check us out. It’s also the method we use to determine if our resources meet your needs. All get-acquainted meetings are free.

Call us (952) 935-0707